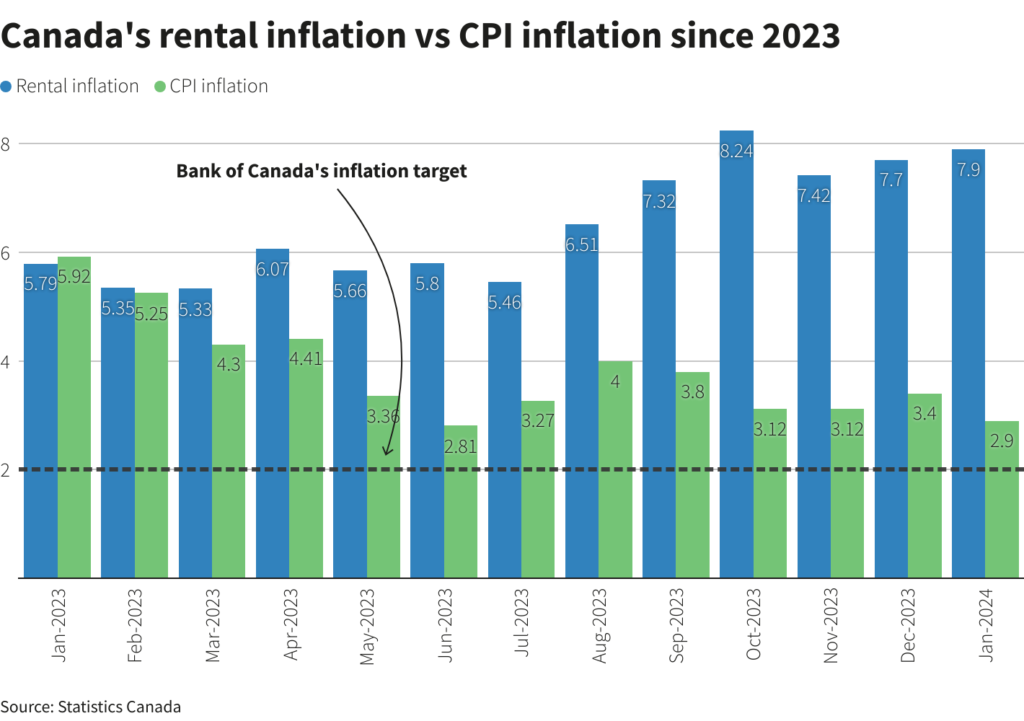

Despite Canada’s inflation rate hitting 2.9 percent in January, rate cuts are not expected till June this year. It was the first time in seven months that headline inflation has dipped below 3%. That prompted money markets to hike bets for a rate cut in April to as much as a 58% chance from a 33% chance before the figures were published. While some are bullish that a rate cut can come as early as April but don’t hold hopes for it as inflation could easily top 3 percent again as gas prices are set to rise in Spring.

By DESIBUZZCanada Staff

OTTAWA – Despite Canada’s inflation rate hitting 2.9 percent in January, rate cuts are not expected till June this year.

It was the first time in seven months that headline inflation has dipped below 3%. That prompted money markets to hike bets for a rate cut in April to as much as a 58% chance from a 33% chance before the figures were published.

While some are bullish that a rate cut can come as early as April but don’t hold hopes for it as inflation could easily top 3 percent again as gas prices are set to rise in Spring.

The Bank of Canada’s next policy announcement is March 6, and expectations are that rates will stay on hold at a 22-year high of 5%. Analysts polled by Reuters had forecast inflation to tick down to 3.3% from 3.4% in December.

Prime Minister Justin Trudeau, whose Liberals are trailing in the polls amid opposition attacks over the soaring price of accommodation and food, described the data as good news.

“We are optimistic that the Bank of Canada will start bringing down interest rates sometime this year, hopefully sooner rather than later,” he told reporters in Vancouver.

Month-over-month, the consumer price index was unchanged, compared with a forecast of a 0.4% rise, Statistics Canada said.

The Bank of Canada targets inflation at 2%. Two of its three core measures of underlying inflation also edged down. CPI-median slowed to 3.3%, the lowest since November 2021, while CPI-trim decreased to 3.4%, the lowest since August 2021.