The Bank of Canada (BoC) delivered its first big rate cut of half a percentage point as Justin Trudeau’s flailing government tries to get their House in order before an election next year. While BoC claimed victory against high inflation on Wednesday as it delivered a supersized interest rate cut and signalled its policy rate will likely continue falling in the coming months, the supposed two percent target might have been met as they say but people are still feeling the pinch from high grocery prices and rising rents and other costs of goods.

By DESIBUZZCanada Staff With News Files

OTTAWA — The Bank of Canada (BoC) delivered its first big rate cut of half a percentage point as Justin Trudeau’s flailing government tries to get their House in order before an election next year.

While BoC claimed victory against high inflation on Wednesday as it delivered a supersized interest rate cut and signalled its policy rate will likely continue falling in the coming months, the supposed two percent target might have been met as they say but people are still feeling the pinch from high grocery prices and rising rents and other costs of goods.

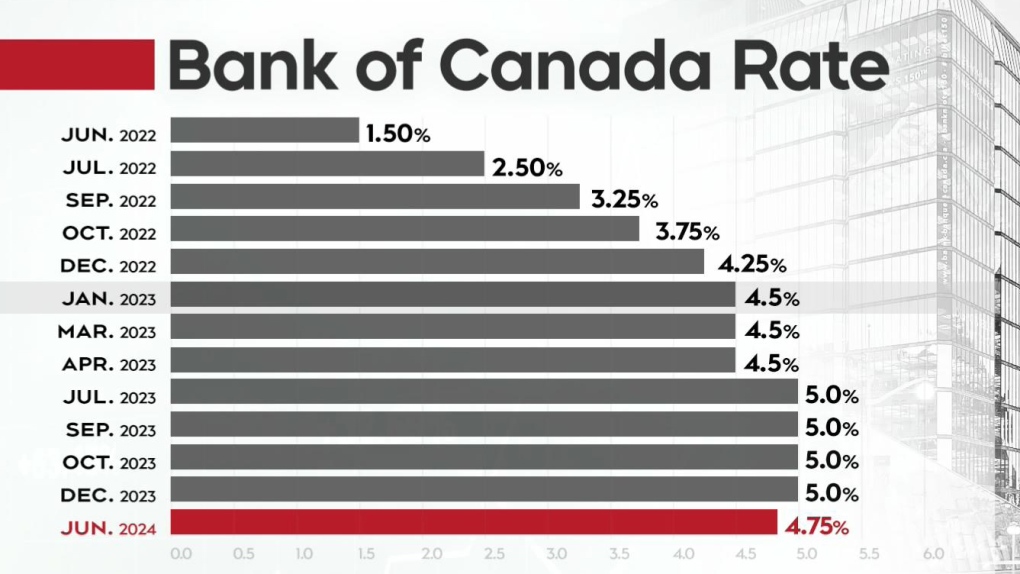

The half-percentage point interest rate cut marks the fourth consecutive reduction since June and brings the central bank’s policy interest rate down to 3.75 per cent.

Canada’s inflation rate fell to 1.6 per cent in September, solidifying forecasters’ expectations for a larger rate cut. Bigger cuts mean the rate can be lowered faster, reported Canadian Press.

BMO chief economist Douglas Porter said his impression of the latest interest rate announcement is that the central bank will likely revert back to quarter-percentage-point rate cuts moving forward.

However, CIBC is still betting on another half-percentage-point cut in December.

The Bank of Canada attributed on Wednesday the slowdown in price growth to shelter price inflation easing, supply outpacing demand in the economy and global oil pricing falling, reported Canadian Press.

It’s now forecasting inflation will remain around the two per cent target throughout its projection horizon, which extends to 2026.

The Bank of Canada’s next interest rate announcement is scheduled for Dec. 11.

Key highlights

*The BoC has historically been hesitant to adjust rates more than 25 bps at a time, so today’s decision to cut Canadian interest rates by 50 bps likely reflects concerns about a slowing economy and the risks of deflation

*Inflation in the third quarter of the year was lower than BoC estimates; the rate in September fell to 1.6%, the first time this rate has been below 2% in more than three years

*The employment rate has been trending downward as employment growth lags population growth; on a year-over-year basis, employment was up 1.5% in September, while the population (aged 15+) increased 3.6%

*When a large cut is announced, it demonstrates a concern that consumers are running out of gas and that the BoC is hoping to ignite the markets before tipping into a recession

*Wednesday’s BoC rate announcement is surely welcome news; however, a more tangible CRE recovery – defined by transaction activity – is still only percolating, rather than materializing in the market

*Even with a cut of this magnitude, CRE transactions will likely remain on the sidelines until mid-2025, when there is confidence that monetary conditions have balanced

With Files from Canadian Press

13 Comments

turkey tv news live

1 year agoYour blog post was so relatable – it’s like you were reading my mind! Thank you for putting my thoughts into words.

Affordable business consulting services

1 year agoThis article really brought clarity to the subject.

YouTube Marketing for Twitch Success

1 year agoYour blog post is a testament to the power of storytelling. You had me hooked from the very first sentence!

Increase YouTube Audience and Leads

1 year agoYour blog post was exactly what I needed to read right now. It’s amazing how you always seem to know just what to say.

Wendell Muller

1 year agoIts like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but other than that this is fantastic blog A great read Ill certainly be back

MM88

4 months agoKhám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

iwin

4 months agoiwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

iwin

4 months agoiwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

iwin

3 months agoiwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

MM88

3 months agoKhám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

GO88

3 months agoTham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

J88

3 months agoĐến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

free binance account

2 weeks agoThanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/es-AR/register-person?ref=UT2YTZSU